2/29 fixing SSL certificate for site encryption, fixing extra security in payments processing still needs testing before launch (it always seems some new things surface unexpectedly!) Thanks for your patience! You can see we are serious about our product!

UPDATE! PrelimLaunchNews AlgoTradersEdge Launches Soon! Will advise date once testing all works OK. Grt $ maker and Daily Best Stock Momentum Pix!

AutoQC testing thru this weekend, site now HTTPS SSL secure!

Get your FREE 2 WEEK TRIAL Very Soon! Will Advise! Keep Watch here for latest updates!

LATEST UPDATE! PAYPAL CODING DUE FINISH THIS WEEK, THEN QA TESTING, THEN SUBSCRIPTION TRIAL BASIS FOR CLIENT SIMULATIONS, & IF LIKE, LIVE PROFITS, IF SIMULATION SHOWS PROFITS POTENTIAL! (look here IB.com simulated trading account info: ) To soon follow with VAT country see:

FRANCHISE OWNER ACCOUNTS FOR TRADERS & NEW BIZOPPORTUNITYSEEKERS! see http://franchiserswantedasap.blogspot.com/ , http://franchisercontract.blogspot.com/ ,

================

Please note: there is paypal payments coding part of project, which is looking up! See: http://hiringfreelancernedded.blogspot.com/ describes coding reqmts but no longer hiring, for how much detailed work is just this part of very complex project! Hence I have submitted entire requirements to several community online coding project sites, asking there be a joint coding effort to finish these requirements, hopefully providing this enhanced paypal coding needed. Without it, the processing is strictly must take CC subscription after trial is up. Looking for sophisticated processing, but with no refunds, so follow UNSUBSCRIBE DETAILS,AS NEEDED, BELOW, but WITHIN 2 WEEKS is subscribe, pay monthly, cancel two days before end of subscription runs out. Also still doing some code testing. Thanks all your patience. YOU'RE GOING TO KEEP YOUR SUBSCRIPTION IF ALL GOES TO PLAN!

$My personal Greeting to all traders with hopes this entire app project gives you great results!$

$$$$ I designed this entire system all out of personal frustrations of Wall St like Vegas Slot Machine robs you everything you've got and more! This hard work is my hopeful answer for all, that finally traders have a real BIG ADVANTAGE: ALGOTRADERSEDGE, the trading algorithm which profits!$$$$

"hello! Im PhilMcDavid@yahoo.com & hope tmy AlgoTradersEdge is great results!

Write me any comments you have, & most of all, I hope you do very well!"

CYANSPRING ATS MAIN USER GUIDE

After you click "Subscribe," you will fill out paypal subscriber user profile information page, which also adds bank &/or CC acct #s, (You get the 2 week FREE TRIAL, then your CC gets charged non-refundable monthly subscription of $300/month, which you can cancel 2-3 biz days before expiration date, same as to cancel your free trial, see HOW2CANCEL instruction, scroll down page near bottom.)

Then you get a download link you click download two CLIENT apps which reside on your home computer, you use to access your algotrading client account on host server now set up for you,

These 2 are the CSTW, "CYAN-SPRING-TRADING-WORKSTATION" for logging into your InteractiveBrokers.com trading account, and placing actual trading orders using your CSTW app, which the ATE algorithm then trades automatically for you, as more described down further below.

Using the AlgoTradersEdge Algorithm, you will need only place either a Single or Multiple (Two Position) Parent Buy Order, which the Algorithm will find the best buy in price to make entry. This will be with stocks or ETFs, which can be mostly momentum trading a single stock or ETF which is strong a given day, or a two position ETF strategy, which as example, could be SPY & SH, these are mirror inverse ETFs, each a 1X type. This follows changes in market trend direction, allows two in/out trades per day's trend change in direction. So you want keep the trailing stops large enough to avoid false triggering, (view both on stockcharts.com, for five days with full price change, of smallest variation, for five days, then take average of the five, use this average as the trailing stop, this is the way I calc trailing stops, hope this helps you also, but use any way works best for you.)

Once you do the buy Parent order placement, the ATE algorithm takes over automatically, and auto-executes the trade, to give the best profit with smallest draw-down losses, for either type of trading strategy you want to do. Start using simulated trading for all strategies you do, before you do any live trading, using the IB.com simulated trading mode first.

The ATE algorithm lets you trade stocks, ETFs, Forex, Futures, Options, and CBOE commodities futures trading, all of these. More on all these types is found here:

CMEgroup , Altavest, Investopedia ,

We want to start a client investing strategies forum eventually.

More on most familar stocks and ETF trading is back to main trading ideas resources page.

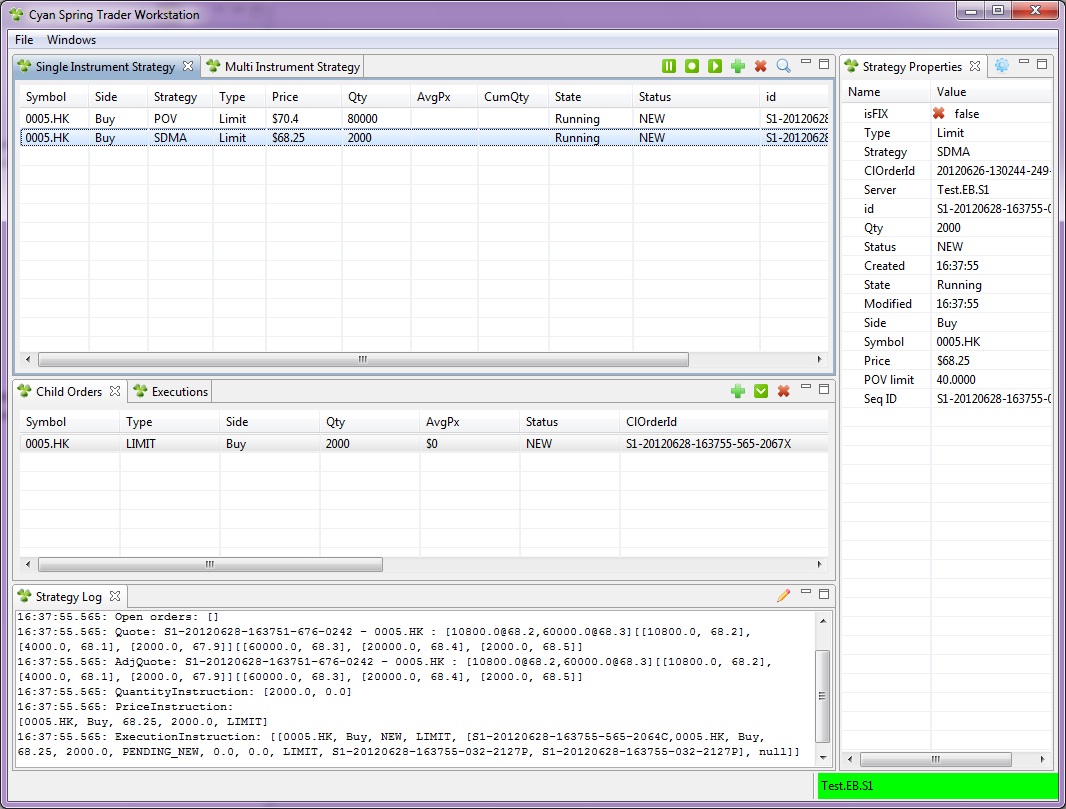

Starting client(CSTW)

Next we go into C:\CATS\CSTW\eclipse and run CSTW.exe. You will see CSTW pops up

There are six functional areas(views) in CSTW:

- Single Instrument Strategy

- Multi Instrument Strategy

- Stategy Properties

- Child Orders

- Executions

- Strategy Logs

Single-Instrument View

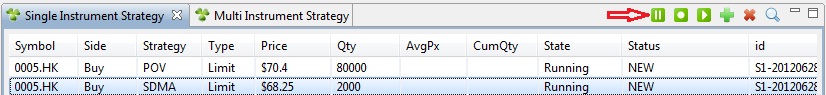

Single-Instrument Strategy is a strategy contains only one order(Parent order). Sometimes they are refered as client orders by broker's term. Sing Instrument view shows all parent orders in a tabular format. The tool bar in this view provides actions we can take on against parent orders:

- Pause order - the algo engine pauses the auto execution of order, but child orders remain staying in downstream/exchange

- Stop order - the algo engine stops the auto execution of order, all child orders are withdrawn from downstream/exchange

- Start order - the algo engine resume the auto execution of order

- Cancel order - the order is canceled. Algo engine withdraws all child orders(if any) and terminate the auto execution

- Show or hide filter - show or hide a filter panel where you may specify a filtering criteria to narrow down the parent orders shown in this view

- Enter order - entering a new parent order for algo execution. More information are in Entering Order Section

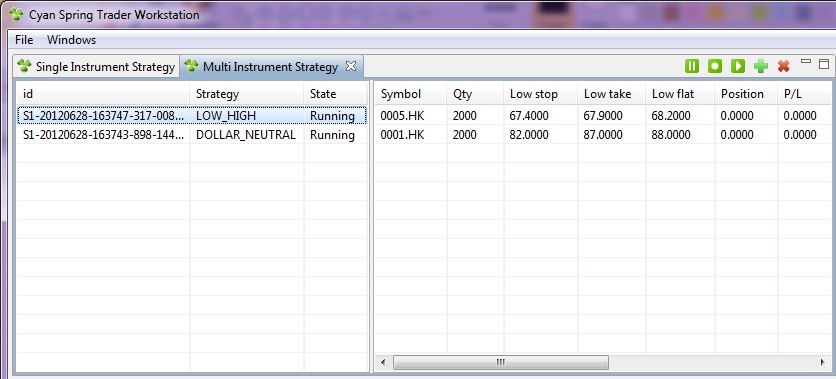

Multi-Instrument View

Multi-Instrument Strategy is a strategy that trades multiple assets.

- Pause strategy - the algo engine pauses the auto execution of strategy, but child orders remain staying in downstream/exchange

- Stop strategy - the algo engine stops the auto execution of strategy, all child orders are withdrawn from downstream/exchange

- Start strategy - the algo engine resume the auto execution of strategy

- Cancel strategy - the strategy is terminated. Algo engine withdraws all child orders(if any) and strategy container removes the strategy from it

- Enter order - create a multi instrument strategy, currently it opens up a file browse dialgo for you to choose a strategy template to load

The left pane shows a list of multi-instrument strategies and right pane shows the instrument and parameters in the strategy you have selected.

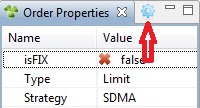

Strategy Properties View

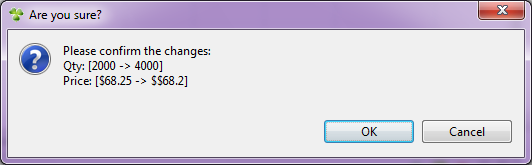

From this view, you are able to see all parameters for a strategy. You may modify those parameters, if they are defined as amendable, by clicking on the following toolbar button:

If the amendment is accepted by server, you will see the parameters are updated in Strategy Properties View. If not, you can check for the error in Strategy Log View.

Child Order View

Here we show all active child orders for a strategy. Completed/canceled child orders are taken out from this view. When a strategy is running, child orders are managed by the algo engine. However, there are always some cases when you want to take control yourself. You may do so by pausing or stopping the strategy first(in single/multi instrument strategy view), then use the toolbar in this view to operate on the child orders.

Strategy Log View

Strategy Log View shows all information related to the status strategy running. You can control the information that is useful but not overwhelming to show to the traders(by coding).Create strategies

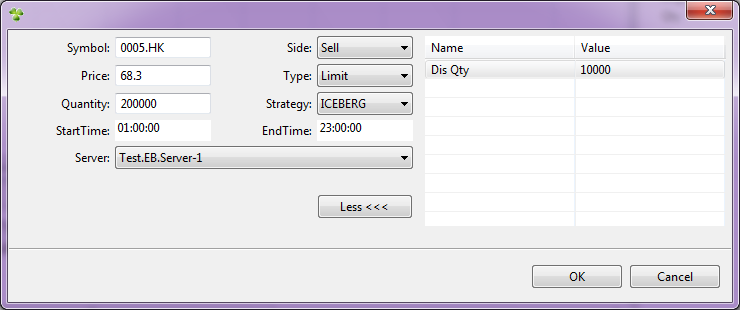

Creating a multi-instrument strategy can be done by loading a template file from the C:\CATS\server\templates directory. Creating a single instrument strategy can be done by clicking on the toolbar button in the Single Instrument Strategy View which brings up a dialog like this

Note: stocks can be entered is defined in C:\CATS\server\refdata\refdata.xml

ConnectionType=acceptor SenderCompID=ACCEPTOR1 SocketAcceptPort=13678 BeginString=FIX.4.2 TargetCompID=INITIATOR1

Also you can use the Cyanspring Trading Simulation Trading App, or the IB.com Simulation Trading App on the InteractiveBrokers.com website trading platform you log into using your CSTW order entry app.

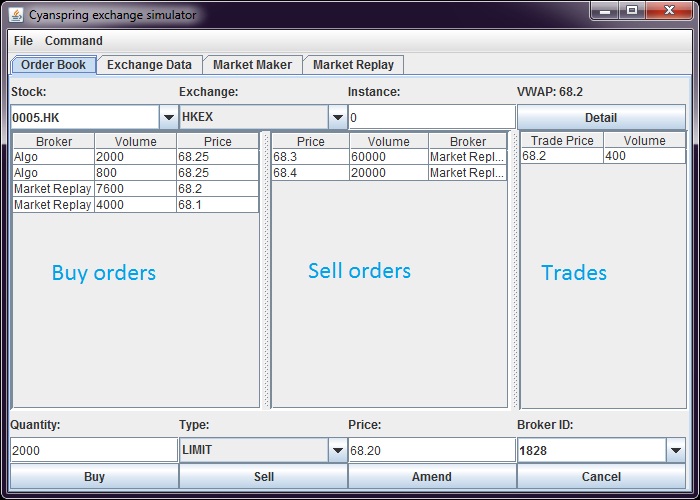

The simulator works like an exchange where orders are queued and matched by price and time priorities. The simulator also generates market data feed to CATS based on the orders enter which drives the strategies moving. Later on, you may use it to create some market activities to test algo orders.

which you use with simulated datafeed to see how your trading orders may go using a simulation trading mode. (Also note you will have a second trading simulation app included within your InteractiveBrokers.com trading account, which you will sign into using your CSTW, which gives the IB log in so you can access your InteractiveBrokers.com trading platform, which will work in sync with the AlgotradersEdge trading algorithm, and how this functions, previously described here,

This URL gives great trading strategies using algotrading:

Most familiar with stocks & forex, still researching best futures and options trading methods.

Seeking a better way we found Braintrading.com Forex MT4 algorithm, then changed it to a completely different programming language, which is totally different, in order to make it able to work with trading for InteractiveBrokers.com trading accounts along with the open source trading app we used, from Cyanspring.com, which has led to AlgoTradersEdge.com great trading advantages as described below, helps retail investors avoid having their emotions get in the way, instead having the algorithm make the closest best timing of trades automatically and much more successfully instead. It uses unique trading algorithm which you can see how it moves directly follows pricing trend two examples you can watch:

FIRST ALGORITHM TRADING EXAMPLE:

http://www.dailymotion.com/video/x3bv6tt_braintrading1-1_tech

AND SECOND ALGORITHM TRADING EXAMPLE

http://www.dailymotion.com/video/x3bv74p_braintrading2_tech

This algorithm is the most accurate predictive methodology (indicator package) to buy bottoms, sell tops, determine trend and trend reversals, was originally developed by BrainTrading Solutions for the futures markets. The BrainTrading ™ System methodology can be applied to any market, any time frame, and is as timely and accurate on FOREX markets, Bonds, Equities and Commodities.

- Buy bottoms and sell tops with low dollar risk.

- Accurate, Visual, Flexible and Easy to Use.

- Generates high probability Mechanical Buy/Sell Signals (70%+).

- Tight Trailing Stops lock in profits and keep you in markets for the big moves.

- Dynamic Trend Indicators show the trading trend for any time frame.

- Day, Swing or Position trade any market with uncanny precision and confidence.

- BrainTrading System uses four sets of independently calculated indicators to indicate a trend and to confirm the trend .

- BrainTrading System catches every trend in its early stage, and never misses a big move. If you have historical data, you can test BrainTrading System performance on any big moves, such as “Black Monday” of 1987 or “Black Tuesday”11 september of 2001. BrainTrading System made exceptional profits in this days!

- BrainTrading System acts on the facts (i.e what the market is doing), rather than bids on the assumptions(i.e. what the market should do).

- The optimal stops furnish people with great flexibility to enter and re-enter the market. BrainTrading Systemprovides optimal stops for every trade objectively. If you know where to exit the market, you can enter the market at virtually any time.

- BrainTrading System is updated with every new tick

- =>BT performs so close like Ablesys 7 Algorithm!

- AbleSys - Award Winning Trading Software System ...

- AbleSys trading software and trading system, Stocks & Commodities Magazine Awards Winning 1997-2015, offers buy/sell/stop trading signal strategies

- Point is: whilenot guaranteedyou can likely use many of the trading ideas you find for Ablesys also for AlgoTraderEdge! Get similar results!

- =>BEST TRADING IDEAS & STRATEGIES HERE:

ABLESYS SITE (You may also find some new ideas in our blog: http://blog.ablesys.com/

Our webinars are available to view on our youtube page, usually a day or two after the live session: https://www.youtube.com/user/AbleSysCorp (please note: this is ONLY a smart suggestion, but odds are a good one indeed!)

- BrainTrading System is the most accurate predictive methodology (indicator package) to buy bottoms, sell tops, determine trend and trend reversals. The BrainTrading System methodology can be applied to any market, any time frame, and is as timely and accurate on FOREX markets, FUTURES, BONDS, EQUITIES and COMMODITIES.=====================================AlgoTradersEdge.com converted it to completely different programming language so you can use it to trade with IB.com! So you can do all there with regular Stock Acct, not only Forex broker, instead regular like IB broker.

HOW2CANCEL instruction

(SUBSCRIPTION OR TRAIL OFFER CANCELLATION

INSTRUCTIONS: go into your Paypal account (use older style settings, much easier to use and follow, go to Profile, Recurring Subscriptions, find listing for AlgoTradersEdge.com, and click to DISABLE SUBSCRIPTION. There is only one offer for the 2 week free trial subscription.)